There’s a pattern emerging, and it’s not just seasonal. From Boulder to Lahaina to Los Angeles, wildfires are becoming more than just environmental events. They are reshaping entire communities, destroying homes, displacing families and, increasingly, threatening the very foundation of the real estate industry in fire-prone regions.

The numbers are sobering. And they tell a story that every homeowner and every real estate professional in the West should be paying attention to.

3 fires, thousands of homes

Let’s start with the facts.

In December 2021, the Marshall Fire ripped through Boulder County, Colorado, just North of our home, destroying 1,084 homes and damaging another 149 in just a matter of hours. My family was fortunate to have only been in the pre-evacuation zone. Fueled by hurricane-force winds and bone-dry conditions, it burned East, becoming the most destructive fire in Colorado history, causing over $2 billion in residential losses alone.

Then came Lahaina.

In August 2023, wildfires swept across western Maui, including Lahaina Town, a historic and cultural center for Native Hawaiians. In total, over 2,200 structures were destroyed or severely damaged. The death toll climbed past 100, and the estimated cost of damage reached $5.5 billion.

Fast forward to January 2025. Southern California erupted into flames with the Eaton and Palisades Fires. Together, they obliterated over 9,400 homes and damaged another 8,700. The total cost? Nearly $52 billion, according to Redfin valuations and LA County loss estimates.

There are many more fires of significance, including those impacting friends in Oregon and the Tahoe fires that broke out while I was there attending a real estate conference for Revaluate.

Each of these fires was unique in its geography, timing and cultural impact. But they share a terrifying common thread: speed, scale and staggering financial damage.

Currently burning

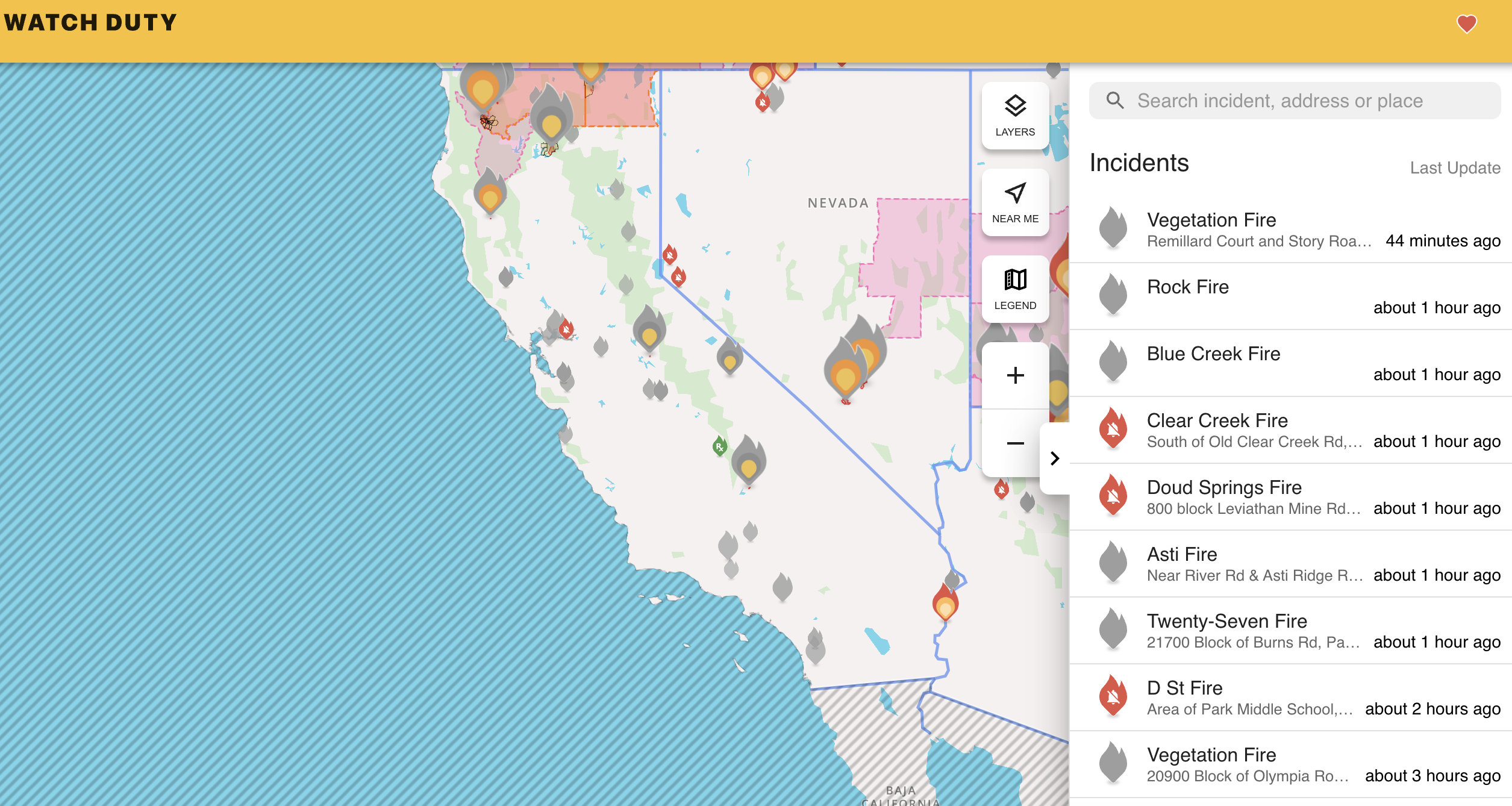

The Watch Duty App keeps me in the know and alerted.

According to the 2025 United States wildfires summary, nearly 42,000 wildfires have been reported nationally so far (at the time of publishing), burning over 3.43 million acres and impacting more than 18,000 structures, with a preliminary fatality count of 30.

More than homes at risk

For homeowners, the impact is direct and devastating. But the ripples extend further — to real estate agents, property managers and brokers who rely on stable communities to operate their businesses.

After the Marshall Fire, local agents in Boulder reported a complete standstill in transactions. MLS activity in the burn zones dropped to near zero for months. Buyers pulled back. Lenders grew cautious. Sellers with standing homes were suddenly unsure whether to stay, sell or rebuild.

In Lahaina, the story is worse. Two years later, fewer than 20 homes have been rebuilt in the fire zone, and over 40 percent of displaced residents still don’t have stable housing. The tourism-reliant economy, already bruised from COVID, is struggling to retain residents, let alone attract new buyers.

And in Los Angeles? While cleanup has been swift (97 percent of debris from the Eaton Fire was already cleared in just six months) rebuilding is lagging. But that’s not shocking because of the slow permit process. The permit processes have improved (down to ~55–60 days from a previous 247), but many homeowners remain in limbo, living in RVs or temporary housing.

Real estate activity in burned neighborhoods has either evaporated or shifted into speculative territory. Agents are reporting more lot listings, but fewer qualified buyers. Builders are cautious. Lenders are stricter. And insurance? That’s a problem unto itself.

The insurance crisis

You may think the fires are the only disaster, but sadly, post-fire insurance in California or Colorado adds an additional disaster cherry on top.

In Altadena, California, homeowners reported six-figure shortfalls between what their insurance will cover and the actual cost to rebuild. Some insurers, like State Farm, are asking for rate increases of 22 percent or more statewide. In Colorado, the average underinsurance gap after the Marshall Fire was $100,000 per household, even after FEMA and SBA stepped in. And that’s for the cost of prior structure rebuild, not the cost of the actual rebuild.

Lack of adequate coverage makes it nearly impossible to rebuild. Which means fewer closings, fewer listings and more families forced to sell land instead of homes.

For agents, this means lost commissions. For brokers, it means watching your farm areas vanish, sometimes literally. And for buyers? Good luck getting a loan on a property in a wildfire zone without jumping through flaming hoops. (Yes, pun intended)

Cultural displacement and gentrification

Beyond the buildings, these fires are altering the very DNA of communities.

In Lahaina, Native Hawaiians are raising alarms that the rebuilding process could push them out of their ancestral land. I don’t see how it wouldn’t. Permits are slow, resources are unevenly distributed and state-led prefabricated housing programs are only temporary.

Altadena, a historically Black and Latino community in Los Angeles County, is seeing a rise in investor activity. Local leaders warn that as burned lots hit the market, outside buyers may reshape the neighborhood, displacing long-time residents in favor of high-end redevelopment.

The result? Real estate agents aren’t just helping people find homes; they’re on the front lines of a cultural battle for who gets to return, who gets to stay and who gets priced out.

What agents should be doing now

The wildfires aren’t going away. If anything, climate models suggest they’re going to get worse, more frequent, more intense and more disruptive.

So, what should agents and brokerages do if living in the fire-prone West?

- Get educated on insurance policy redlining in your markets. Know which areas are losing coverage and which carriers are still active.

- Double down on resilience-focused inventory. Homes with fireproof materials, defensible space and hardening upgrades will command a premium—and survive longer.

- Support your clients with rebuild navigation. Whether it’s understanding SBA loans, permit pathways or local advocacy, agents who help guide recovery earn long-term loyalty.

- Partner with local resilience initiatives. In Boulder, Wildfire Partners helped thousands of homeowners reduce risk. Being part of that conversation matters.

- Watch for signs of cultural displacement. Use your voice and your business to support equity and access in rebuilding.

A new kind of market

Fire isn’t just burning homes. It’s burning away the old assumptions that used to define real estate in the West.

Buyers aren’t just asking about schools and walkability; they’re likely asking about fire zones, evacuation routes and insurance surcharges. Sellers aren’t just prepping for showings, they’re weighing the risk of rebuilding versus cashing out.

And agents? You’re no longer just dealmakers. In fire country, agents need to be advocates, educators and in many ways … first responders of a different kind. (But perhaps that can set you apart.)

If the past three years have taught us anything, it’s that fire doesn’t just destroy structures. It changes markets. It challenges careers. And if we’re not paying attention, it will burn us.

Chris Drayer is co-founder of Revaluate, which segments consumers for marketers by propensity to move.