Indian e-commerce startup Citymall[1], which focuses on budget-focused grocery delivery for tier 2 and tier 3 towns, said today that it has raised $47 million in Series D funding led by Accel, with participation from existing investors including Waterbridge Ventures, Citius, General Catalyst, Elevation Capital, Norwest Venture Partners, and Jungle Ventures.

The Series D round comes three years after the company’s $75 million Series C round[2] led by Norwest Venture Partners. The valuation of the company at $320 million has remained flat over this period. According to sources familiar with the deal who spoke with TechCrunch, investors used nearly a 4x multiple of Citymall’s past year of revenue as a benchmark. The company has raised $165 million to date.

Investors in Citymall told TechCrunch that the prior valuation reflected a bullish market environment at the time, which explains why the valuation has remained unchanged despite the company’s growth. However, they remain optimistic about the company’s trajectory.

“We have been an investor in Citymall since the Series A, and we wanted to double down with this investment because we think online grocery shopping, and the value segment within that, is the largest consumer market in India,” Pratik Agarwal of Accel told TechCrunch over a call.

Citymall’s funding comes at a time of a quick-commerce frenzy in the Indian market. Companies like BlinkIt[3], Zepto[4], Swiggy Instamart, and Tata-owned BigBasket are rushing to serve customers within 10 minutes. Citymall wants to take a different approach by targeting a different customer segment.

The startup targets value-conscious customers who make planned purchases of groceries instead of ordering for their immediate needs through quick-commerce apps. Citymall CEO Angad Kikla explained that the app offers about half the product selection (SKUs) of a quick commerce app but double the selection of an offline value store. (SKUs, or “stock keeping units,” refer to the number of different products available.)

“While e-commerce is growing as a segment, the penetration of online grocery is low,” Kikla said. “Most of the folks in India are value-conscious while buying groceries. We want to cater to that cohort. We want to think of ourselves as an equivalent of Dmart in the online world,” he said, referring to the publicly listed superstore chain.

Techcrunch event

San Francisco | October 27-29, 2025

The startup, founded in 2019, initially relied on community leaders in different cities to market its product, take orders, and handle last-mile fulfillment before COVID-19 struck. During the early pandemic period, when people were just getting introduced to ordering groceries online, some customers needed hands-on assistance. After that period, the company switched to using community leaders only for fulfillment to reduce costs and streamline operations.

The company’s strategy focuses on building private labels and partnerships with manufacturers to offer goods at lower prices than competitors, while creating margins through operational and supply chain efficiencies. Unlike quick commerce startups, Citymall doesn’t charge any handling or delivery fees, and it typically delivers goods in a day rather than in minutes for value-minded customers who don’t need items immediately.

Citymall says that customers earning anywhere from ₹15,000 to ₹80,000 a month ($170-$910) are its primary user base. The company reports an average order value of ₹450 -500 (between $5-6).

The company operates in 60 cities, including Delhi NCR, Uttar Pradesh, Haryana, Bihar, and Uttarakhand. Kikla said Citymall aims to expand to cities adjacent to its current markets to better utilize its existing warehouses.

While Citymall has seen steady business growth over the last three years, the company had over 30% negative EBIDTA margins for the last financial year, according to the research firm Entrackr[5]. The startup said that it is operationally profitable but didn’t provide a timeline for achieving overall profitability.

The company is operating in competitive sector that’s facing pressure from local stores, online grocery platforms, and even quick commerce platforms. According to Bloomberg Intelligence, quick commerce platforms are poised to capture 20% of e-commerce sales in India by 2035[6].

Manish Kheterpal, co-founder of Waterbridge Capital, a firm that has invested in Citymall in multiple rounds, said that quick commerce encourages impulse spending through marketing to users. In contrast, he said Citymall’s lower operating costs compared to quick commerce competitors give it an edge.

“Citymall offers cheaper essentials to users who might order a few times a month. The company buys goods directly from suppliers and uses its community leaders to achieve to low cost of distribution that results in building a healthy gross margin,” Kheterpal told TechCrunch.

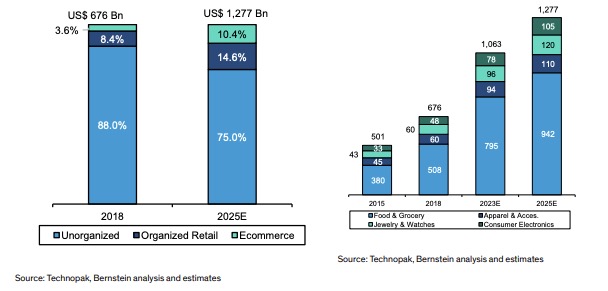

According to analysis by Bernstein Research, food and grocery dominate India’s largely unorganized retail sector. The firm also estimates that online grocery shopping will account for 12% of e-commerce sales by the end of this calendar year.

Despite quick commerce’s rapid growth, companies operating beyond metropolitan areas face higher per-order costs, according to an analysis[7] by the strategy firm Redseer. Citymall’s thesis is that value-conscious customers will choose its platform over quick commerce due to lower fees and product costs. By combining this with lower delivery costs, the company believes it can achieve better economies of scale by serving more users.

References

- ^ Citymall (techcrunch.com)

- ^ $75 million Series C round (techcrunch.com)

- ^ BlinkIt (techcrunch.com)

- ^ Zepto (techcrunch.com)

- ^ Entrackr (entrackr.com)

- ^ 20% of e-commerce sales in India by 2035 (www.bloomberg.com)

- ^ an analysis (redseer.com)